Non-Technical Summary

Somali piracy has created a major externality due to disruption to shipping, especially in the Gulf of Aden. How costly is this anarchy? This column analyses micro-data on individual shipping contracts and finds that piracy increased transport costs by around 8%. The $120 million in net revenues that pirates generate are more than offset by the costs borne by the shipping industry, which lie between $0.9 billion and $3.3 billion.

Max Weber defined a functioning state as “a human community that (successfully) claims a monopoly of the legitimate use of physical force within a given territory”. This does not apply to Somalia.

In Somalia, the effective monopoly of power has not been with any form of state since 1991. It has been topping the list of the failed states index for the past five consecutive years (Foreign Policy 2012).

- The disastrous US intervention in Mogadishu in October 1993 led to a shift in US foreign policy towards non-intervention in Somalia.

- Unchecked by outside forces, the state further fragmented into several smaller regions that were dominated by warlords.

As such it became a refuge for radical Islamists and organised crime. But it was only after the rise in piracy attacks in the first decade of the century, especially after 2008, that the world seemed to take notice of the situation in Somalia.

Somali piracy has created a major externality due to disruption to shipping, especially in the Gulf of Aden. But how costly is this externality from statelessness? What is the equivalent tax rate that arises from all the costly reactions to avoid the piracy risks? And how does this tax rate compare to a general tax on shipping through the area?

Our recent research aims to answer these questions (Besley et al. 2012). In additional to providing new information on Somalia, our work also sheds light on the key questions about the role of institutions in securing trade from predation and theft (Dixit 2004).

Piracy at a maritime choke point

Our analysis of the ‘piracy tax’ comes from micro-data on individual shipping contracts1. We consider the direct link between the risk of piracy attacks and the cost of shipping by studying the impact on chartering rates on maritime routes that vary due to

- Weather conditions and

- The extent to which they are exposed to Somali piracy at different dates.

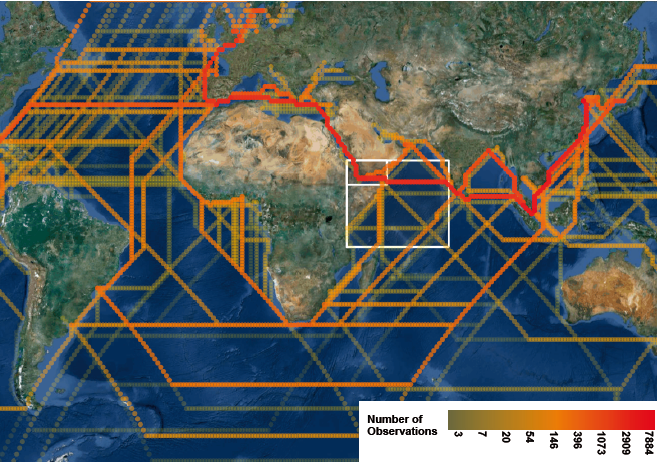

Most of the trade between Asia and Europe has to pass through the Gulf of Aden and is thus, potentially affected by Somali piracy. The fact that the Gulf of Aden is one of the busiest shipping routes is clearly illustrated by our chartering-contracts data, which show that roughly 25% of our ships travel through the Gulf of Aden (Figure 1).

Figure 1. Calculated shipping lanes

This graphical representation highlights how important the Suez Canal is for world trade. Anything that disrupts trade through the Suez Canal has the potential to disturb trade patterns. The role of the Suez Canal and its impact on trade is confirmed in Feyrer (2009) which looks at the Suez Canal closure as a natural experiment.

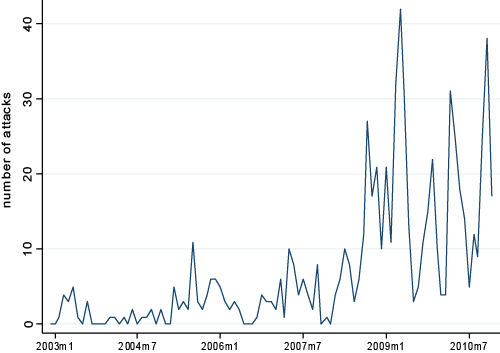

We argue that the upsurge in piracy in the spring of 2008, which becomes evident when studying the monthly time series of attacks (Figure 2), has been disrupting trade and has led to several responses by the shipping industry. The costs of these responses are passed on to those who charter ships that pass through the region, and hence are ultimately paid by the consumers of traded goods. The impact on shipping rates is how we estimate the ‘piracy tax’.

Figure 2. Time series of attacks in Somalia

Bringing both datasets together, we find that piracy caused an increase in the transport cost of around 8%. We identify this increase in the cost both from the sudden increase in violence intensity in spring 2008, but also from seasonal variation due to weather patterns.

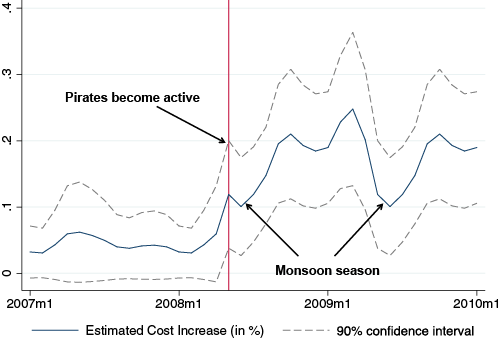

In particular, early summer is a period of relatively little piracy activity. We show that this is due to the monsoon season, which just makes it difficult for pirates to operate in their small vessels. Hence, the estimated effect varies significantly with the season as the risks are lower. This is illustrated in the following picture (Figure 3). The piracy tax is lower in the monsoon season. We check that this drop in shipping rates is not due to less shipping through the area.

Figure 3. Shipping cost prediction of pirate activity and wind speed

Using these estimates, we can provide some bounds on the overall cost of Somali piracy by scaling up the point estimate by aggregate measures of trade through the region. Using these, we find that:

At the lower bound, the $120 million in net revenues that pirates generate are more than offset by the costs borne by the shipping industry, which lie between $0.9 billion and $3.3 billion.

Clearly, such estimates are subject to a wide confidence band. However, their foundation lies in solid micro-econometric estimates.

One way to benchmark this, is to compare the revenues generated by piracy to an equivalent tax rate on traffic through the Gulf of Aden or the broader Somali territorial waters. If we go down this avenue, we estimate that the equivalent tax rate on traffic would be well below 1%.

So what does this say about the costs of piracy? It highlights that a functioning Weberian state would likely be able to implement redistributive policies a lot more efficiently than a ‘roving bandit’ (Olson 2000).

Conclusions

Is there a solution to Somali piracy?

One route which seems favoured in some quarters is a private response which increases the number of private security guards. We estimate the costs of this and argue that it makes a lot of sense given the costs of such guards. And there are now signs that piracy is falling as more ship owners and charterers pursue this option.

The alternative would be to seek cooperation between the governments of affected countries to internalise the externality through a cooperative defence effort. This is also being attempted. But, international cooperation is difficult to muster, due to varying geopolitical interests of the players involved. And there is a chance that history will repeat itself. For example, the correspondent report on Chinese piracy in The London and China Telegraph from 4 February 1867 noted that:

“Besides we are not the only Power with large interests at stake. French, Americans, and Germans carry on an extensive trade […] Why should we then incur singly the expense of suppressing piracy if each provided a couple of gunboats the force would suffice for the safety foreign shipping which is all that devolves upon […] why should the English tax payer alone bear the expense?”

Either way, our research shows that looking for ways to solve this does lead to the possibility of manifest welfare gains.

Besley Tim, Thiemo Fetzer & Hannes Mueller, 2012, “One Kind of Lawlessness: Estimating the Welfare Cost of Somali Piracy”, Working Papers 626, Barcelona Graduate School of Economics.

Dixit, Avinash, (2004). Lawlessness and Economics: Alternative Modes of Governance. Princeton University Press, New Jersey.

Feyrer, James, (2009). Distance, Trade, and Income: The 1967 to 1975 Closing of the Suez Canal as a Natural Experiment. NBER Working Paper, 15557.

Foreign Policy (2012), “The 2012 Failed States Index, Interactive Map and Rankings”, foreignpolicy.com

Olson, Mancur (1993), “Dictatorship, Democracy, and Development”, American Political Science Review, 87(3):567-576.

One Earth Future Foundation, (2010, 2011), “The Economic Costs of Maritime Piracy”, Working paper.

The Welfare Cost of Lawlessness: Evidence from Somali Piracy, joint with Tim Besley and Hannes-Felix Mueller. Journal of the European Economics Association, Volume 13, Issue 2, pages 203 – 239, April 2015.

Abstract

In spite of general agreement that establishing the rule of law is central to properly functioning economies, little is known about the cost of law and order breakdowns. This paper studies a specific context of this by estimating the effect of Somali piracy attacks on shipping costs using data on shipping contracts in the dry bulk market. To estimate the effect of piracy, we look at shipping routes whose shortest path exposes them to piracy and find that the increase in attacks in 2008 led to around an 8% to 12% increase in costs. From this we calculate the welfare loss imposed by piracy. We estimate that generating around 120 USD million of revenue for Somali pirates led to a welfare loss in excess of 630 USD million, making piracy an expensive way of making transfers.

Press Coverage & Non-Technical Summaries

2013

Financial Times 🇬🇧, Foreign Policy 🇺🇸, IGC 🇬🇧, Quartz 🇺🇸, VoxEU 🇬🇧, Washington Post 🇺🇸.